The real estate sector can be a lucrative investment XLRE ETF forecast opportunity for investors seeking diversification. The XLRE ETF, which represents the broader real estate market, provides a streamlined way to gain exposure to this dynamic sector. This article examines in detail of the XLRE ETF, exploring its holdings, recent trends, and risks and considerations. By understanding the key factors driving of this ETF, investors can navigate the complexities of real estate investing.

- Evaluate the risks associated with investing in the XLRE ETF, including market volatility and interest rate fluctuations.

- Assess the liquidity of the XLRE ETF, considering its trading volume and bid-ask spreads.

{Investing in the XLRE ETF presents access to exposure to the real estate sector without the need for direct property ownership. Understanding the limitations of this ETF and its potential risks before making any investment decisions.

Analyzing XLRE Stock Performance: Opportunities and Risks

XLRE has recently experienced a volatile period, presenting both promising opportunities and inherent risks for investors. While the company's underlying metrics indicate robust growth, external factors could negatively impact its future performance. Carefully evaluating XLRE's earnings reports is crucial for strategic investment decisions.

Moreover, it's essential to competitive landscape that could shape XLRE's continued growth. A thorough research process is necessary to identify potential both the benefits and risks associated with investing in XLRE stock.

Dissecting the Recent Performance of the XLRE ETF

The XLRE ETF witnessed a fascinating recent performance trajectory. Investors are eagerly scrutinizing the drivers behind this movement.

Some prominent metrics to consider include current sector dynamics, trader sentiment, and financial developments. Understanding these interplay can provide valuable insights into the ETF's prospects.

Moreover, it's important to analyze the volatility associated with participating in this specific ETF. A thorough analysis is vital to make strategic allocation decisions.

Does XLRE Represent a Solid Investment for Your Real Estate Portfolio?

When seeking your real estate portfolio, you're always on the lookout for reliable opportunities. XLRE, with its focus on modern property ventures, has certainly caught the attention of many investors. But is it truly a viable investment? The answer isn't always straightforward and depends heavily on your individual investment strategy.

On the positive side, XLRE often targets high-growth markets with future prospects , which could lead to significant appreciation. Their broad range of properties can also help mitigate risk . However, it's crucial to carefully analyze on any specific XLRE investment before committing your funds. Factors like market conditions can all influence performance.

Decoding the Factors Influencing XLRE ETF Returns

Successfully understanding the intricate factors impacting XLRE ETF returns requires a multifaceted approach. Analysts must diligently analyze the performance of real estate holdings, coupled with an astute understanding of macroeconomic trends, interest rate fluctuations, and regulatory movements. Moreover, investor plays a pivotal role in shaping XLRE's trajectory, making it essential to monitor prevailing market views. By dissecting these interwoven variables, informed decisions can be made regarding management of assets within this volatile sector.

XLRE's Trajectory: Exploring Real Estate ETF Success

In the ever-evolving landscape of financial markets/investing opportunities/market dynamics, Exchange Traded Funds (ETFs) have emerged as a popular vehicle/instrument/strategy for investors seeking to diversify/expand/allocate their portfolios. The real estate sector, known for its stability/potential for growth/historical resilience, presents a particularly attractive/promising/intriguing avenue within this diverse/expansive/dynamic ETF space/realm/landscape. XLRE, the leading/popular/premier Real Estate Select Sector SPDR Fund, has garnered significant attention/interest/recognition due to its performance/track record/success and ability to provide exposure/access/investment to a broad range of real estate companies.

Analyzing/Examining/Reviewing XLRE's past performance/historical trends/data points can offer valuable insights/clues/predictions into the future outlook/potential/prospects for this ETF and the broader real estate sector/market/industry. Factors such as interest rates/economic growth/regulatory changes play a crucial role in shaping real estate investment trends/performance/dynamics, and understanding these influences/forces/elements is essential for investors seeking to navigate/understand/predict the complex world of real estate ETFs.

- Furthermore/Additionally/Moreover, considering macroeconomic factors/global trends/industry-specific catalysts can provide a more holistic perspective/understanding/viewpoint on XLRE's future trajectory/potential growth/investment appeal.

- By carefully evaluating/thoroughly assessing/analyzing these intertwined variables/complex factors/dynamic influences, investors can make more informed decisions/strategic choices/intelligent investments regarding their real estate ETF exposure/allocations/holdings.

Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! James Van Der Beek Then & Now!

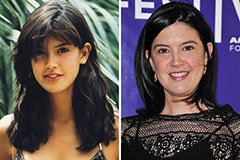

James Van Der Beek Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!